Solar rebates are changing the game for homeowners and businesses looking to switch to renewable energy. They make solar panels more affordable, helping you save money while supporting a cleaner planet.

However, sorting through these advantages can sometimes feel like a complicated task. In this guide, we’ll break down how solar rebates work, demonstrate how to use them to cut costs and walk you through the application process step by step.

You’ll also get insights into state-specific programs and understand the economic perks of going solar. Plus, we tackle common myths about solar rebates head-on and peek into the future of renewable energy incentives.

Are you geared up to fully tap into your advantages? We’ve got practical tips that’ll help you do just that.

Ready to make your home a model of sustainability and efficiency? Contact YellowBall Roofing & Solar today and take the first step towards a greener, more cost-effective future.

Table Of Contents:

- Understanding Solar Rebates: A Comprehensive Guide

- Navigating the Application Process for Solar Rebates

- State-Specific Solar Rebate Programs

- The Economic Benefits of Investing in Solar Energy

- Common Misconceptions About Solar Rebates

- The Future of Solar Rebates and Renewable Energy Incentives

- Tips for Maximizing Your Solar Rebate Benefits

- FAQs about Solar Rebate

- Embracing the Future: How Solar Rebates Can Transform Your World

Understanding Solar Rebates: A Comprehensive Guide

When enhancing your home with solar energy in Montana and Wyoming, understanding the landscape of solar rebates can significantly impact your decision.

At Yellowball Roofing & Solar, we’re dedicated to guiding you through this process, ensuring you’re equipped with all the necessary information to make an informed choice about solar electricity systems.

The Basics of Solar Rebates

Solar rebates are incentives governments or utility companies provide to lower the cost of installing a solar electricity system on your property.

These financial incentives encourage homeowners and businesses to adopt renewable energy sources by making them more affordable.

- Federal Solar Tax Credit (ITC): One significant rebate is the Federal ITC, allowing you to deduct a portion of your solar installation costs from your federal taxes.

- State-Specific Incentives: Montana and Wyoming offer unique state-specific incentives that can be combined with federal rebates for even more significant savings. It’s essential to research these options thoroughly or consult experts like us at Yellowball Roofing & Solar for personalized advice tailored to your location.

- Utility Company Programs: Some local utility companies provide additional utility rebates or credits for homes contributing surplus energy to the grid through net metering. This reduces initial setup costs and potentially lowers ongoing electricity bills.

Navigating Your Options Wisely

Selecting the right mix of rebates requires careful consideration based on individual circumstances such as geographic location, system size preferences, and long-term sustainability goals.

Our team at Yellowball Roofing & Solar excels in offering comprehensive consultations that evaluate these factors alongside potential rebate opportunities, maximizing benefits while minimizing out-of-pocket expenses for our clients in Montana and Wyoming interested in sustainable living solutions.

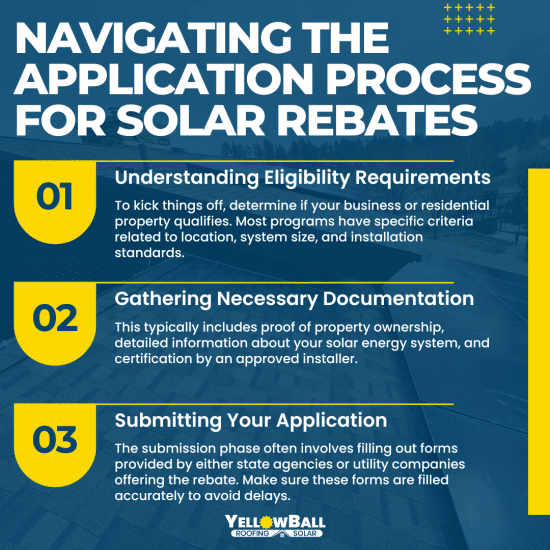

Navigating the Application Process for Solar Rebates

Applying for solar rebates might initially seem intimidating, but with a clear plan, it becomes much more manageable. This pathway is carefully designed to guide you from start to finish.

Step 1: Understanding Eligibility Requirements

Step 1: Understanding Eligibility Requirements

To kick things off, determine if your business or residential property qualifies. Most programs have specific criteria related to location, system size, and installation standards.

Different states offer various incentives that can significantly reduce initial costs and improve ROI on solar installations. Knowing what’s available in your area and any upcoming changes that could affect eligibility is crucial.

Step 2: Gathering Necessary Documentation

Gathering all required documentation beforehand will streamline the process. This typically includes proof of property ownership, detailed information about your solar energy system (such as capacity and estimated production), and certification by an approved installer.

Step 3: Submitting Your Application

The submission phase often involves filling out forms provided by either state agencies or utility companies offering the rebate. Make sure these forms are filled accurately to avoid delays. Some programs allow online submissions, while others may require mailing physical documents.

Tips For Smooth Processing

- Avoid peak application periods by submitting early in the year when possible.

- Maintain copies of all submitted materials in case there’s a need for resubmission or verification.

- Frequently check on your application status online if such a feature is available.

State-Specific Solar Rebate Programs

Exploring Montana’s Solar Rebate Opportunities

Montana offers unique solar rebate programs that encourage local businesses and residents to adopt solar energy solutions.

Montana’s commitment to renewable energy is evident through incentives like net metering, which allows solar system owners to receive credits for excess energy generated, and renewable energy certificates (RECs).

These RECs provide an additional revenue stream for solar producers, showcasing the state’s efforts to promote sustainable energy adoption and market growth.

Additionally, Montana provides specific tax exemptions and credits for solar installations, reducing the overall cost for businesses looking to transition to solar power.

These initiatives lower the upfront investment required for solar installations and promote long-term sustainability and energy independence for Montana’s businesses.

Harnessing Solar Rebates in Wyoming

Wyoming, known for its vast open spaces and abundant natural resources, is gradually embracing solar energy.

While the state’s solar rebate programs are not as extensive as in some neighboring states, there are still opportunities for businesses and homeowners to benefit from solar installations.

Wyoming primarily focuses on utility-scale solar projects, but local incentives and federal tax credits can make solar installations more financially viable for small businesses.

By taking advantage of these available incentives, businesses in Wyoming can reduce their energy costs and contribute to the state’s renewable energy goals.

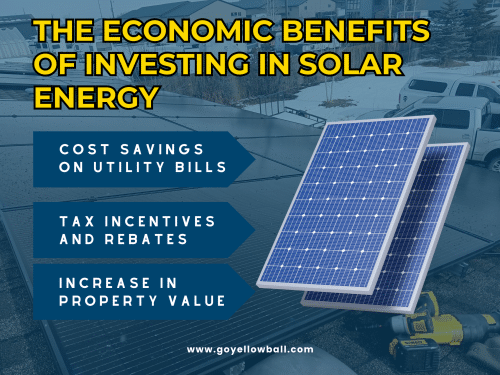

The Economic Benefits of Investing in Solar Energy

Switching to solar energy is like planting a money tree in your backyard. It reduces monthly electric utility bills, increases property value, and provides significant tax incentives.

Cost Savings on Utility Bills

Cost Savings on Utility Bills

Solar panels significantly reduce or even eliminate your electricity bills. From the moment they’re activated, these systems start generating free power for over 25 years, the average lifespan of a solar panel system.

Studies have shown that homeowners can save thousands over the lifetime of their solar system, depending on where they live.

This savings potential is enhanced by net metering policies available in many states, which allow you to sell excess electricity back to the grid at retail prices.

Explore tools like Solar Estimate’s calculator to see how much you could save.

Tax Incentives and Rebates

Federal and state administrations have put forth enticing tax deductions and cashback offers for those installing solar systems to foster green energy uptake.

For instance, the Investment Tax Credit (ITC) allows you to deduct 26% of your installation costs from your federal taxes through 2033 before it decreases to 22% in 2034.

The Residential Clean Energy Credit also enables homeowners to deduct 30% of the cost of installing eligible renewable energy systems, including solar panels, from their federal taxes, supporting eco-friendly home upgrades.

Beyond federal incentives, many states have additional rebates that lower the initial cost barrier for going solar.

These programs vary widely across different regions; thus, checking local resources or consulting with experts at YellowBall Roofing & Solar can provide specific insights into what’s available in your area.

Increase in Property Value

Homes equipped with solar energy systems sell faster and command higher prices than non-solar homes, thanks in part to property tax incentives for renewable energy.

Appraisers now consider renewable energy installations valuable assets when calculating home values, recognizing that buyers are willing to pay a premium for homes with minimal to zero electric bills.

Research indicates that installing a standard-sized photovoltaic system adds an average boost equivalent to nearly $6k per installed kilowatt—meaning a modestly sized system could increase home value by upwards of $15k.

Common Misconceptions About Solar Rebates

Solar Rebates Are Too Complicated to Understand

Many believe that solar rebates are complex, making them hard to grasp. But the truth is quite the opposite.

Navigating the world of solar incentives is made easier with straightforward rules and defined qualifications for those interested. Agencies often have hotlines or online support to help applicants through the process.

Solar Rebate Programs Are Only for Homeowners

A common myth suggests that only homeowners can benefit from solar rebate programs. This isn’t true.

Depending on their location and program specifics, businesses, non-profits, and even renters (with landlord permission) can sometimes access these incentives.

Programs such as those detailed by DSIREUSA.org show a wide array of options available for homeowners and commercial entities looking to reduce energy costs through solar investments.

You Missed Out If You Didn’t Apply Right Away

Many people feel a strong fear of missing out when it comes to solar rebates. They worry they’ll miss their chance if they don’t act immediately.

However, new programs launch regularly, while existing ones frequently receive funding boosts or extensions.

To stay updated on opportunities, checking state-specific resources or subscribing to newsletters from reputable renewable energy organizations will keep you in the loop without missing your chance to benefit from these valuable incentives.

The Future of Solar Rebates and Renewable Energy Incentives

As renewable energy evolves, the incentives supporting it change too. This transformation is crucial for companies and individuals investing in solar energy.

Emerging Trends in Solar Rebate Programs

As technology advances and our dedication to the environment grows, the landscape of renewable energy incentives is always changing.

One key trend is the rise of localized incentive programs tailored to regional needs. Local businesses favor these programs because they cater to their specific requirements better than nationwide initiatives.

Additionally, there’s a growing emphasis on bundling rebates with other financial assistance like tax credits and grants. This multi-dimensional strategy lowers upfront costs, making solar energy even more appealing.

Potential Policy Shifts Impacting Solar Investments

A significant conversation around renewable energy incentives revolves around policy shifts at both state and federal levels. Anticipated changes could either bolster or challenge current rebate systems.

The Department of Energy’s Solar Energy Technologies Office is critical in shaping these policies, focusing on innovation to reduce costs and increase accessibility.

In states like California,California’s Distributed Generation Statistics show how aggressive renewable portfolio standards (RPS) push utilities towards adopting greener solutions – potentially influencing rebate structures nationwide as others follow suit.

Navigating Uncertainties with Strategic Planning

In the dynamic landscape of solar rebates and incentives, strategic planning is paramount for businesses seeking to capitalize on future opportunities.

As legislative developments shape the renewable energy sector, companies must remain vigilant and adaptable.

Staying informed about emerging policies and regulations is essential. By closely monitoring legislative changes and industry trends, businesses can anticipate shifts in the incentive landscape and adjust their strategies accordingly.

This proactive stance allows companies to position themselves advantageously and make informed decisions about their solar investments.

Tips for Maximizing Your Solar Rebate Benefits

Getting the most out of solar rebates means being strategic. Here’s how you can ensure no money is left on the table.

Know Your Deadlines

To maximize your benefits, timing is everything. Many rebate programs have strict deadlines that, if missed, could mean missing out on savings.

Mark these dates in your calendar and start the application process early to avoid any last-minute rush.

Visiting websites like the Department of Energy’s database can be beneficial for detailed timelines and deadline information. Explore this guide for a full rundown of rebates and tax incentives available in each state.

Maintain Proper Documentation

Gathering all necessary documents beforehand is crucial. This includes purchase receipts, certified installer invoices, and proof of residence or business location within eligible areas for specific rebates.

Lack of proper documentation is one major reason applications get delayed or denied. To help navigate this step smoothly, consult resources such as DSIREUSA.org, which provides guidelines on what paperwork is required for each type of incentive program.

Understand Eligibility Requirements

Familiarize yourself with eligibility criteria before applying. Some programs may require energy audits or installation by certified professionals to qualify for incentives.

Knowing these requirements upfront saves time and ensures compliance with program standards.

- Determine whether your project meets local building codes and environmental regulations.

- Evaluate if system size falls within allowed limits.

- Check if there are additional incentives for using certain technologies or products recommended by participating rebate programs.

FAQs about Solar Rebate

How does the solar 26% tax credit work?

You get to shave off 26% of your total solar installation costs from your federal taxes. It’s like a discount for going green.

Do I get the solar tax credit back in a refund?

Nope, it reduces what you owe in taxes. If you don’t owe anything, no cash back for you this time.

Can you write off solar panels on taxes?

Absolutely. Solar panels qualify as a deduction under the federal investment tax credit, trimming down your taxable income.

Does South Carolina have a solar energy tax credit?

Sure does. Residents can knock an extra 25% off their state taxes thanks to South Carolina’s own incentive.

Embracing the Future: How Solar Rebates Can Transform Your World

Getting solar rebates is not just brilliant—it changes everything. You now know how to use solar energy to save money and help the planet.

Every state has its own solar rebates, offering fantastic ways to save on bills and make the earth greener. The benefits are clear: lower costs and a healthier environment are easy to achieve with these incentives.

Don’t worry about solar rebates being too complicated. You have all the information you need, and the future looks bright with renewable energy.

If you’re ready to reduce energy costs and support a cleaner world, it’s time to go for it. Solar rebates are waiting for you!

Embrace a future where your home is not just a living space but a proof of sustainability. Reach out to YellowBall Roofing & Solar for innovative solutions to make your home more energy-efficient. Your journey towards a sustainable home starts here.

.png)