Imagine trimming down your energy bills while you boost your property’s value. Get ready to dive into the ins and outs of getting those sought-after free solar panels through government programs.

We’ll guide you through federal tax credits that can slash installation costs, dig into state rebates, and shed light on local initiatives that might foot the bill for your solar setup.

Thinking beyond today? We’ve got insights on leases and PPAs that could mean zero upfront costs.

Plus, we’ll walk you through applying for these sweet deals step by step. Say goodbye to myths about free solar panels; let’s get down to what’s real.

Ready to make your home a model of sustainability and efficiency? Contact YellowBall Roofing & Solar today and take the first step towards a greener, more cost-effective future.

Table Of Contents:

- Unveiling the Truth About Free Solar Panels from the U.S. Government

- Navigating Federal Solar Incentives for Cost Reduction

- State-Specific Solar Programs and Rebates

- Local Initiatives and Non-Profit Organizations Offering Solar Assistance

- Evaluating Solar Leasing and Power Purchase Agreements (PPAs)

- Grants and Funding Opportunities for Solar Energy Projects

- Steps to Apply for Government-Supported Solar Programs

- Myths vs. Facts About Free Solar Panels

- FAQs about Free Solar Panels

- Navigating the Path to Government-Supported Solar Panel Installation

Unveiling the Truth About Free Solar Panels from the U.S. Government

The promise of free solar panels can sound like a siren’s call to homeowners and businesses looking to cut energy costs and contribute to environmental sustainability.

But is there any truth behind these offers? The reality may not be as straightforward as some would hope.

Many are enticed by ads claiming that the government will cover the full cost of solar panel installations.

While it’s true that government incentives exist, they don’t typically make solar entirely free. Instead, they aim to reduce your out-of-pocket expenses significantly.

Navigating Federal Solar Incentives for Cost Reduction

The journey to significantly reducing solar panel installation costs often leads homeowners and businesses to the federal government’s doorstep.

The Federal Solar Investment Tax Credit (ITC), a cornerstone of solar cost savings, has been making waves by allowing taxpayers to deduct a portion of their solar investment from their federal taxes.

Understanding the Solar Investment Tax Credit

The ITC isn’t just another drop in the ocean; it’s a powerful tide that can cover up to 26% of your system costs if installed before December 31, 2034.

Afterward, this percentage decreases slightly but still offers substantial relief.

This incentive is not just about immediate benefits; it also bolsters property value while slashing utility bills over time. Beyond personal gains, tapping into the ITC means actively supporting green energy initiatives nationally.

By investing in renewable resources like solar power through these incentive programs, you contribute toward national goals for sustainability and cleaner energy production, which help mitigate the impacts of climate change.

Eligibility Criteria for Claiming the ITC

To make sure you’re on solid ground with claiming this tax credit, there are specific criteria you must meet: You need ownership over your photovoltaic (PV) system, and it must be new or being used for the first time.

The Internal Revenue Service (IRS) looks at “original use” as starting with you when determining eligibility, so leasing doesn’t count here.

An important thing to remember is that although touted as ‘free money,’ this credit reduces tax liability rather than providing direct payment.

To maximize its potential, it is most effective if you have sufficient tax credits to fully utilize them within one fiscal year or to carry forward any unused portions following the rules established by the IRS.

Maximizing Your Savings Through Strategic Planning

So, it’s crucial to start your projects promptly and keep them moving forward without a hitch.

This approach secures the current beneficial rates and puts you in a strong position should any legislative changes arise after the 2034 deadlines.

State-Specific Solar Programs and Rebates

Each state in the U.S. offers unique solar incentives that can help you slash costs on your energy bill.

But figuring out which ones apply to you can feel like a maze.

New York’s NY-Sun Incentive Program

The Empire State shines with its NY-Sun Incentive Program, where residents get affordable solar financing options.

The program provides rebates that reduce installation costs upfront, making it easier for homeowners to go green.

This initiative also supports community solar projects, allowing people who may not have suitable roofs for panels to still benefit from solar power by subscribing to a shared system.

Texas’ Renewable Energy Systems Property Tax Exemption

The Lone Star State takes pride in big savings with property tax exemptions on renewable energy systems.

By installing new solar panels on your home in Texas, they won’t increase your property taxes even though they add value to your house.

Texas’ incentive ensures long-term affordability by preventing those added taxes every year following an upgrade with sustainable technology, a value for Texans looking after their wallet and their world.

Montana Rural Solar Access Project

The Montana Rural Solar Access Project (MRSAP) is an innovative initiative designed to bring renewable energy solutions to the often-overlooked rural areas of Montana.

By focusing on these communities, MRSAP aims to improve access to solar technology for residents facing logistical and financial barriers when harnessing solar power.

The project supports environmental sustainability and seeks to reduce energy costs for rural households, enhance energy independence, and stimulate local economies through job creation in the green tech sector.

Through partnerships with local entities and possible incentives, MRSAP is committed to equitable clean energy distribution across Montana’s diverse landscapes.

Go green with YellowBall Roofing & Solar! Expert guidance, seamless installation, and lower bills. Get your solar solution today!

Local Initiatives and Non-Profit Organizations Offering Solar Assistance

Across the nation, local initiatives and non-profit organizations are stepping up to boost communities with solar energy.

They understand that while upfront costs can be daunting, the long-term savings from solar power are substantial.

These groups help homeowners tap into renewable energy sources by providing free or low-cost solar panels.

Solar For All: Bringing Power to the People

In places like Washington, D.C., programs such as Solar for All aim to cut electricity bills in half for qualifying households through community solar projects.

These initiatives prioritize families who could benefit most from decreased utility expenses but may not have access to traditional financing options.

This commitment by local leaders ensures more residents can participate in clean energy transitions without bearing financial burdens alone.

It exemplifies how targeted efforts can make sustainability accessible for all community members.

Harnessing Community Support Through Solar Co-ops

Beyond individual programs, group endeavors like solar co-ops unite neighbors interested in going solar.

These cooperatives leverage collective bargaining to secure discounts on panel purchases and installations and effectively reduce costs below market rates.

The cooperative model also offers support throughout the process, from understanding technology options to selecting reputable contractors—creating a smoother transition for those new to solar energy systems.

Funding The Future With Grants And Donations

Numerous foundations recognize the importance of alternative energies and offer grants specifically designed for residential or commercial conversion to photovoltaic systems.

The Database of State Incentives for Renewables & Efficiency (DSIRE) is one resource where individuals can search for available funding opportunities within their state or locality.

Organizations often fundraise themselves, pool donations, and then provide no-cost installations in underserved neighborhoods.

This shows how communal giving promotes environmental stewardship and fosters tangible economic improvements within communities.

Evaluating Solar Leasing and Power Purchase Agreements (PPAs)

When you’re eyeing solar energy to slash those hefty electric bills, jumping at offers for ‘free’ panels is tempting.

However, savvy homeowners know that digging into the details of solar leasing and PPAs is crucial.

Understanding Solar Leases

These options don’t require the upfront costs of buying panels outright, but they come with rules.

Solar leases are like renting your rooftop: A third party owns the solar system on your home, and you pay them a monthly fee. This can be less than you usually pay for electricity, which sounds great on paper.

However, remember that these contracts typically last 20-25 years—you’ll want to check if this aligns with your long-term housing plans.

Deciphering Power Purchase Agreements (PPAs)

With PPAs, things get more interesting because instead of paying rent for equipment, you agree to buy power from the provider who installs and maintains the panels on your roof—at a rate usually lower than local utility prices.

So, while there might not be an installation fee waving at you upfront, ensure you understand how much this will cost over time; some PPA rates increase annually.

Lease or PPA: Which Aligns With Your Financial Goals?

Analyzing whether a solar lease agreement or PPA suits your financial goals better requires looking beyond just monthly payments versus savings on utilities.

Factor in potential tax benefits or incentives available when owning solar systems compared to leasing or PPAs where ownership remains with another entity.

Always read through any contract thoroughly before signing onto something as significant as installing a new energy system; it could affect everything from property value to future selling points.

Make the switch to solar simple with YellowBall Roofing & Solar! From initial design to final installation, we’re committed to excellence in powering your home sustainably.

Grants and Funding Opportunities for Solar Energy Projects

Finding the funds to support solar energy projects can feel like a treasure hunt.

But with government agencies and private entities stepping up, there’s gold at the end of the rainbow for those who know where to look.

Federal Grants and Tax Incentives

The U.S. Department of Energy (DOE) leads the charge with initiatives that push solar technology forward.

One standout program is the Solar Energy Technologies Office, which offers funding opportunities to drive innovation in solar technologies.

These are not direct grants but fuel research that can trickle down benefits to residential customers.

More directly accessible is the renowned Solar Investment Tax Credit (ITC), offering significant deductions on federal taxes following solar installations.

This credit has been extended multiple times, highlighting its importance in America’s renewable energy strategy.

Pioneering Private Initiatives

Apart from governmental efforts, various private foundations also recognize the value of sustainability by backing renewable ventures generously.

The Database of State Incentives for Renewables & Efficiency® (DSIREUSA.org) lists hundreds of such programs nationwide, each potentially reducing installation costs or providing outright grants.

Navigating these opportunities requires some savvy skills, knowing your eligibility criteria is crucial before applying, and patience since processing applications may take time.

Key Takeaway:

Chase down solar savings by tapping into federal tax incentives, state-level rebates, and private grants. These funds make going green more affordable than ever. Dig into resources like the DOE’s initiatives or DSIREUSA.org to find programs that could slash installation costs.

Steps to Apply for Government-Supported Solar Programs

Finding the path to solar energy through government support involves a few key steps.

Each one is important, and taking them in order can help you navigate the process smoothly.

Gather Your Energy Usage Data

The first step is understanding your current energy consumption.

Grab recent utility bills or use an online energy audit tool provided by the U.S. Department of Energy (DOE). This data will be crucial when estimating your potential savings with solar panels.

Research Federal Incentives like ITC

Dig into federal incentives such as the Solar Investment Tax Credit (ITC). The ITC allows you to deduct a percentage of your solar costs from your taxes, making it easier on your wallet upfront.

Inquire About State-Level Programs and Rebates

Your state may have additional programs that could reduce costs even more. Visit DSIRE (Database of State Incentives for Renewables & Efficiency®) for a comprehensive list of local incentives available in your area.

Contact Local Non-Profit Organizations

Some non-profits work tirelessly to make renewable energy accessible. They might offer free installation based on qualifications like income level or location, so reaching out can open doors you didn’t know existed.

Evaluating Eligibility Criteria

To see if these opportunities are right for you, check their eligibility criteria carefully against your situation – this will save time and effort when applying for assistance.

Filling Out Applications Accurately

If everything lines up, fill out applications thoroughly and accurately—attention to detail here prevents back-and-forth communication which can delay installation plans.

If selected, follow through diligently with any additional paperwork required by these organizations; prompt responses keep things moving forward efficiently towards sunny days ahead powered by clean solar energy.

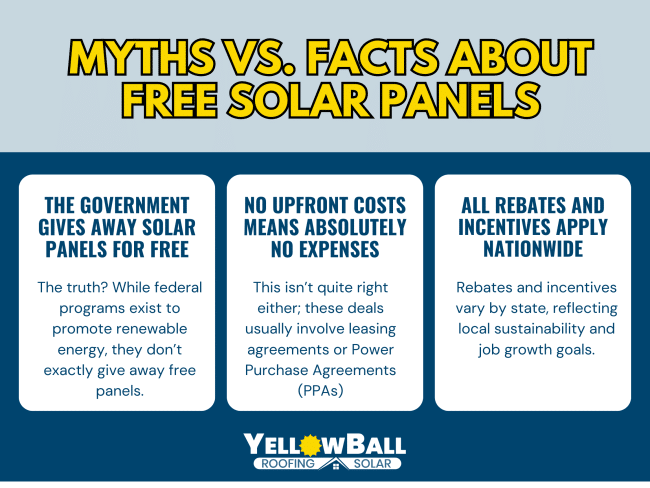

Myths vs. Facts About Free Solar Panels

Solar energy is gaining traction, but many homeowners are still puzzled about ‘free’ solar panels.

It’s time to separate fact from fiction and shed light on your expectations regarding complimentary solar solutions.

The Government Gives Away Solar Panels for Free

One common belief is that the government sells solar panels at no cost. The truth? While federal programs exist to promote renewable energy, they don’t exactly give away free panels.

Instead, incentives such as tax credits help slash installation costs significantly.

No Upfront Costs Means Absolutely No Expenses

Another myth suggests that a zero upfront cost equals an entirely free system.

This isn’t quite right either; these deals usually involve leasing agreements or Power Purchase Agreements (PPAs), where you pay for the power your leased solar equipment generates over time.

A different approach with its own set of long-term financial considerations.

All Rebates and Incentives Apply Nationwide

Folks sometimes think all rebates and incentives apply across the board—no matter where you live in the U.S., which isn’t true because there’s a patchwork of state-specific programs designed around regional goals for sustainability and green jobs growth.

You’ll need to check what’s available in your area and meet specific eligibility criteria to benefit.

By busting these myths with facts from reliable sources within our industry, YellowBall Roofing & Solar aims to inform and empower customers looking into sustainable energy options—including those curious about so-called ‘free’ solar panel offerings.

FAQs about Free Solar Panels

Can you get free solar panels in the US?

No-cost solar panels are rare. Yet, through tax breaks and incentives, your out-of-pocket costs can reduce significantly.

Is solar-free in Florida?

Solar isn’t free in Florida, but state policies can help cut installation prices big time.

Is there free solar in AZ?

Nope, Arizona doesn’t hand out solar for nothing. But rebates and tax credits make it way more affordable.

Can I get free solar panels in Montana?

In Montana, solar panels aren’t free, but tax credits and net metering can lower costs; consult local energy experts for specific renewable opportunities.

Navigating the Path to Government-Supported Solar Panel Installation

Wrap your head around this: free solar panels can be a reality. We’ve walked through the government’s solar incentives offers, tax breaks, and local helping hands that make it happen.

Remember the ITC? That sweet deal cuts costs big time, and don’t forget those state programs with their perks.

Dig into community projects and non-profits next door; they might just set you up at no charge. Then there are leases and PPAs – think long-term gain over short-term spending.

To lock in these benefits, follow our step-by-step guide on applications. Be wise to myths; know what’s possible with free solar panels.

Embrace a future where your home is not just a living space but a proof of sustainability.

Reach out to YellowBall Roofing & Solar for innovative solutions to make your home more energy-efficient. Your journey towards a sustainable home starts here.