Thinking about installing solar panels in Bozeman? Now is a smart time to look into it.

Between rising energy prices, growing interest in sustainability, and evolving incentives from the federal and state governments, Bozeman homeowners and businesses are asking the right question: What kind of Bozeman solar tax credits are available, and how can I maximize my savings in 2025?

Here’s what you need to know to get the most out of going solar in Bozeman this year.

Why Now: 2025 Is a Key Year for Solar in Bozeman, Montana

2025 is shaping up to be a pivotal year for Bozeman solar tax credits. With utility costs continuing to fluctuate and more homeowners seeking energy independence, the available tax credits and Montana solar rebates can make a solar investment more accessible than ever.

Many of these programs, especially at the federal level, have phase-outs scheduled in future years—so the sooner you act, the more you could potentially save.

And in Bozeman? You’re in a city that enjoys over 200 days of sunshine a year — more than enough to make solar a realistic option for homes and businesses alike.

Federal Solar Tax Credit (ITC) in 2025

Let’s start with the big one: the Federal Investment Tax Credit (ITC). For 2025, the federal solar tax credit allows you to claim 30% of the cost of your solar installation on your federal taxes, provided you meet eligibility requirements.

Here’s what that means in simple terms:

- If your solar system costs $20,000, you could receive a $6,000 tax credit.

- This isn’t a deduction—it’s a dollar-for-dollar credit, which means it reduces what you owe on your taxes directly.

- The 30% credit is expected to hold through 2032, but changes in legislation can occur. Taking advantage of it now ensures you lock in current savings.

These federal solar incentives in Montana are available to Bozeman residents who install qualifying solar systems.

Learn more from the official resource: U.S. Department of Energy – Federal Solar Tax Credit

Important: Always consult a licensed tax professional or you can contact YellowBall Roofing & Solar to understand how these incentives apply to your unique financial situation.

Montana State Solar Tax Benefits (Specific to Bozeman Residents)

Bozeman solar tax credits don’t stop at the federal level. Montana offers a couple of powerful incentives to Bozeman homeowners who want to go solar:

1. Montana Energy Tax Credit

You may be eligible to receive up to $500 per individual (or $1,000 per household) as a tax credit on your Montana state return.

This applies to qualifying renewable energy systems, including solar.

Official reference: Montana Department of Environmental Quality – Tax Incentives

2. Property Tax Exemption for Solar in Bozeman

- Normally, adding value to your home increases your property taxes.

- In Montana, solar systems are exempt from property tax assessments for up to 10 years.

- This means you can boost your home’s value with solar without worrying about a tax hike.

These Montana solar rebates and exemptions help make Bozeman solar tax credits even more financially attractive for homeowners.

Bozeman Utility-Specific Solar Incentives

If you live in Bozeman and are served by local utility companies such as NorthWestern Energy, you may be eligible for additional benefits.

Bozeman residents can take advantage of net metering, which lets you earn credits for sending excess solar energy back to the grid.

Some programs may offer rebates or special pilot programs for battery storage or EV chargers.

Tip: A local solar installer like YellowBall Roofing & Solar can help you navigate Bozeman-specific utility programs to ensure you get the full range of available benefits.

How the Bozeman Solar Tax Credit Works in Real Life

Let’s say a Bozeman homeowner installs a solar system for $22,000 in early 2025:

- Federal Tax Credit: $6,600 (30% of system cost)

- Montana State Credit: $1,000 (if filing jointly)

- Property Tax Exemption: No added property taxes on the increased home value

Total possible savings: $7,600, not including any Montana solar rebates or long-term energy savings.

That means your system could effectively cost around $14,400, and continue to pay for itself over time

Bozeman solar tax credits in 2025 make this a financially strategic year to act.

Solar Panels in Bozeman’s Cold Climate: Yes, They Work Here

One of the biggest myths we hear in Bozeman is: “Does solar really work in a snowy place like this?”

The short answer? Yes.

Cold temperatures actually help solar panels operate more efficiently. While snow may occasionally cover panels, Bozeman’s high number of sunny days and proper panel angle design allow systems to perform effectively year-round.

Bonus: YellowBall Roofing & Solar uses high-quality, bifacial solar panels designed to perform efficiently—even during Bozeman’s shorter winter days and reflective snowy conditions.

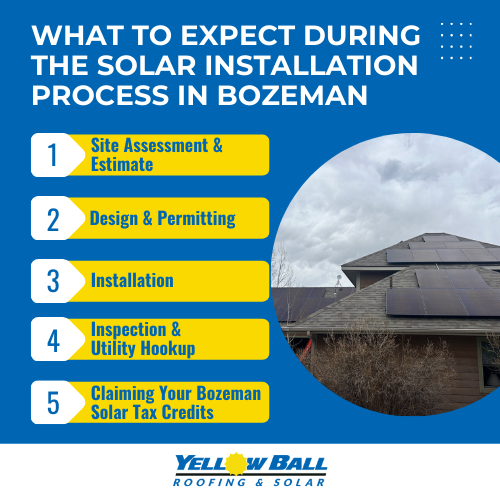

What to Expect During the Solar Installation Process in Bozeman

What to Expect During the Solar Installation Process in Bozeman

If you’re considering solar in 2025, here’s how the process generally works for Bozeman residents:

- Site Assessment & Estimate

- Design & Permitting (including city of Bozeman regulations)

- Installation

- Inspection & Utility Hookup

- Claiming Your Bozeman Solar Tax Credits

A qualified, local installer can walk you through each step, making sure everything is compliant with local codes and optimized for your specific property.

Choosing the Right Installer in Bozeman Matters

Not all solar companies are created equal. At YellowBall Roofing & Solar, we specialize in Bozeman installations and understand the unique local regulations, weather, and incentives.

We serve homeowners and businesses across Bozeman, helping clients create energy-efficient, lower-cost futures with a reliable, locally rooted partner.

We don’t just install solar—we help maintain systems with year-round snow and cleaning services that keep things running efficiently.

FAQs About Bozeman Solar Tax Credits

Can I use both the federal and Montana state solar tax credits in Bozeman?

Yes. Bozeman residents can apply both the 30% federal solar tax credit and the Montana state energy tax credit on qualifying solar installations.

Will installing solar panels increase my property taxes in Bozeman?

No. Thanks to Montana’s property tax exemption, your solar system won’t increase your property tax bill for 10 years.

What if I don’t owe enough in taxes to use the full credit in one year?

The federal solar tax credit is eligible for carryover. If you don’t use the full amount in one year, the remaining balance may roll over to the following year.

Final Thoughts: Start with a Free Bozeman Consultation

The path to solar can seem overwhelming, but with the right support and the right timing, it doesn’t have to be.

Want to see if solar is a smart investment for your home or business in Bozeman?

Start with a free consultation from a local, trusted installer. No pressure. Just honest answers.

Contact YellowBall Roofing & Solar today to explore your Bozeman solar tax credit opportunities for 2025.

Disclaimer: This blog is for informational purposes only and should not be considered financial or tax advice. Please consult a licensed tax advisor for personalized guidance.